Hi,

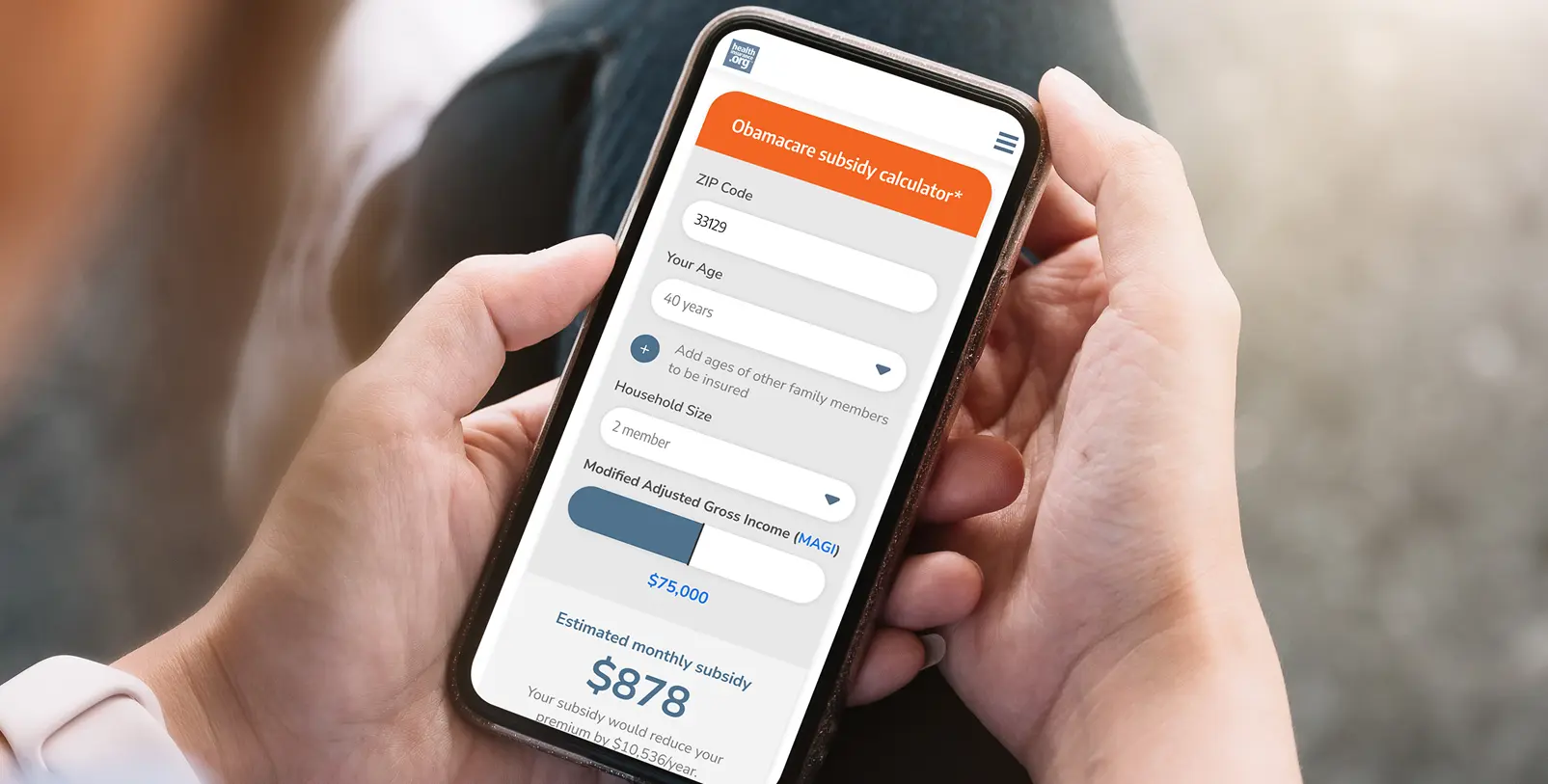

So I will be losing my health insurance coverage in June because I am turning 26. Currently, my average hours are at 21, so I will not be eligible through Target and intend to apply for coverage on the marketplace under the ACA. Over the summer, I will be taking fewer classes and was originally planning on working full time for a couple months until I go back to part time in the fall. If i become eligible for benefits through Target, I will lose the tax credit that makes the marketplace insurance affordable. Has anyone navigated this before? I want to know how quickly if I pop over 25 hours would my tax credit be impacted. Also, when I lose my insurance coverage, do they check my eligibility through Target based on my average hours at that time, or based on my average hours on my last W2?

Thanks

So I will be losing my health insurance coverage in June because I am turning 26. Currently, my average hours are at 21, so I will not be eligible through Target and intend to apply for coverage on the marketplace under the ACA. Over the summer, I will be taking fewer classes and was originally planning on working full time for a couple months until I go back to part time in the fall. If i become eligible for benefits through Target, I will lose the tax credit that makes the marketplace insurance affordable. Has anyone navigated this before? I want to know how quickly if I pop over 25 hours would my tax credit be impacted. Also, when I lose my insurance coverage, do they check my eligibility through Target based on my average hours at that time, or based on my average hours on my last W2?

Thanks